Flexi Wallet

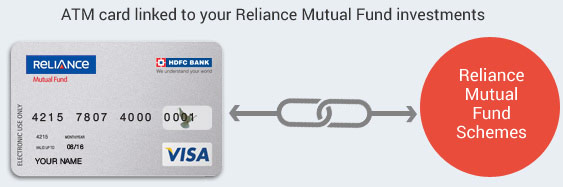

Today, plastic money is a popular way to access a bank account or a credit account for cash withdrawals or shopping, but what if you could do the same for your mutual fund portfolio? Reliance Any Time Money is a debit card that combines the advantages of mutual funds with the ease of a debit card. While conventional Mutual Fund investments can give market-linked returns with the added benefits of diversification, low cost, liquidity, and expert management, access to these funds, which is largely offered through physical redemptions, is not instantaneous. We also provide Planning & suggestion for your hard-earned money.

The Reliance Any Time Money Card provides mutual fund investors with immediate access to cash. As a result, you may now access your assets at any time of day or night. While your Asset allocations are collecting interest, you may access them whenever you choose.

Features of Reliance Anytime Money Card

- In India, the card may be used to withdraw cash from Visa-enabled ATMs and to make purchases at merchant locations, much like a standard debit card.

- A daily Visa enabled ATM cash withdrawal limit of 50% of the balance in the primary plan account or up to the bank's allowed limit, whichever is lower, is available.

- A daily purchase limit of 50% of the amount in the principal scheme account*, or $100,000, whichever is smaller, applies on a daily basis.

- Waiver of the fuel surcharge

- Free transaction notifications via SMS and email *A primary scheme account allows you to access your funds at any Visa-enabled ATM or merchant location in India. Only Reliance Liquid Fund - Treasury Plan/ Reliance Liquid Fund – Cash Plan/ Reliance Money Manager Fund can be used as the primary plan account.

Your Reliance Mutual Fund schemes are connected to the card, giving you fast access to your investments. The card will provide you access to Visa-enabled ATMs and merchant outlets across India, allowing you to withdraw and spend against your mutual fund assets or Asset allocation. Essentially, it combines the benefits of investing with the convenience of a Reliance Mutual Fund Debit Card connected to your assets.